Welcome to the exciting world of real estate investing with Lake Chapala Realty If you are looking for a sound and profitable financial strategy, real estate investing is the perfect choice. Our team of experts will guide you every step of the way, from identifying the best market opportunities to securing a smooth transaction. With us, you’ll enjoy passive cash flows and the ability to revalue your assets. Start building your wealth today with Lake Chapala Realty and take a confident step toward a prosperous financial future.

- Determine whether you are interested in short term or long term gains – are you looking to generate a steady monthly cash flow through rentals, or are you more focused on long term property appreciation?

- Consider your risk tolerance. Some properties may offer more stable but lower returns, while others may have higher potential returns but also greater volatility.

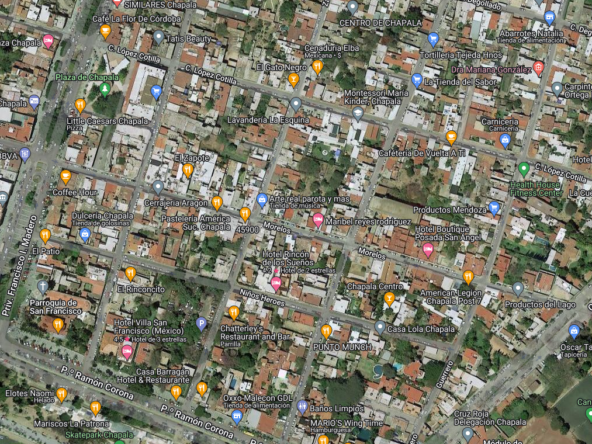

- Scan the local real estate market and look for areas with good growth potential. Research rental demand, vacancy rates, average sales prices and market trends.

- Analyze factors such as location, nearby amenities, access to transportation, schools and other services. These aspects can influence the demand and future value of the property.

- Consider working with a local real estate agent or consultant who is knowledgeable about the market and can provide you with up-to-date data and information.

- Determine how much you are willing to invest in a property. Take into account acquisition costs such as down payment, closing costs and agent commissions.

- Calculate ongoing expenses, such as taxes, insurance, periodic maintenance and repairs.

- If you plan to finance the purchase, shop around for different mortgage loan options and compare interest rates, terms and requirements. Make sure you can comfortably afford the monthly mortgage payments.

- Avoid putting all your capital in a single property. Consider investing in different types of properties, such as apartments, single-family homes, commercial properties or land.

- You can also diversify geographically by investing in properties in different areas to reduce the risk associated with relying on a single market.

Seek guidance from experienced real estate professionals, such as agents, brokers or financial advisors who specialize in real estate. They can provide valuable information on market trends, help you evaluate properties and guide your investment decisions.

- Conduct a thorough inspection of any property you are considering purchasing. Evaluate its structural condition, installations, electrical and plumbing systems, and any potential problems.

- Research the legal history of the property to make sure there are no legal problems or pending litigation.

- Consider working with a real estate attorney to review and advise you on the terms of the purchase contract.

- Compare the financing options available and choose the mortgage loan that best suits your needs. Consider factors such as interest rates, terms, down payment requirements and loan conditions.

- Make sure you fully understand the terms and obligations of the loan before you sign any agreements. Calculate the monthly payments and evaluate how they will affect your personal finances.

- It is essential to have an emergency fund to cover unexpected expenses, such as major repairs or extended periods of vacancy.

- The ideal is to set aside between 5% and 10% of the income generated by the property to cover unforeseen expenses. This will give you financial security and prevent you from facing difficulties if unforeseen events occur.