Financing the purchase of a home, in the form of a mortgage loan, offers several benefits that allow individuals to access homeownership without having to pay the full price of the home all at once.

One of the most obvious benefits of financing is that it allows you to buy a home even if you don’t have the full amount of money to do so. You can purchase a property and start building equity, rather than having to rent indefinitely.

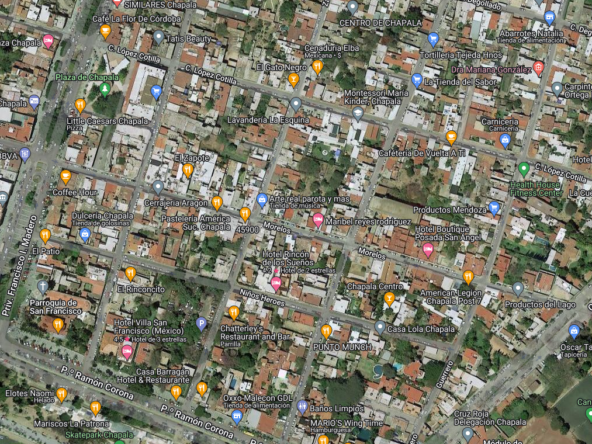

Real estate ownership can be a solid, diversified investment in your financial portfolio. In addition to providing a place to live, properties can increase in value over time, potentially providing you with a return on investment.

Mortgage loans allow you to leverage debt in a favorable way. You can buy a home with a relatively small initial investment (the down payment) and finance the rest. If the value of the property increases over time, the return on your investment is greater than the amount of money you have personally invested.

Mortgage loans often have fixed monthly payments for the life of the loan. This makes budget planning easier, since you know how much you will have to pay each month.

If the real estate market is favorable and the value of the property increases, you could benefit from property appreciation. This could allow you to sell the house in the future for a higher price than you originally paid.

In many countries, mortgage interest is often tax deductible. This can reduce your tax burden and make the cost of having a mortgage more affordable.

Owning your own home can provide a sense of stability and rootedness. You can customize the property to your preferences, establish connections with the community and create a place that feels like your own.

If you decide to move in the future, you can consider keeping the property and turning it into a source of income by renting it out. This could generate a steady stream of money and increase your assets.